The importance of choosing the right broker

There’s no denying that we live in a society that’s becoming more time poor. Juggling home life, work life, social life and our voluntary commitments is taking up all of our time. And for club managers and committees, reviewing the intricacies of an insurance policy can take a great deal of reading. Choosing the right insurance is time-consuming and complex. Yet, signing up for something that’s not exactly right could leave your club unprotected, risking catastrophe.

An insurance broker is essential to acquiring the best insurance for your club. Tailoring your policy to your club’s unique aspects and needs is critical to staying fully protected. Brokers are experts, able to negotiate with insurers to get you the best deal. This doesn’t mean that understanding your insurance should take a back seat. It’s often only thought of when a crisis arises and by then it’s often too late. Club managers should try to understand their insurance and have a direct line with their broker to ask any questions or to notify of any changes.

How to choose the right club insurance broker?

When choosing the right insurance broker, it can be easy to be hyper-focussed on the price of the premium. With the cost of living crisis and material cost increases, clubs are under financial pressure, and insurance is a large expense, despite it’s incredible importance.

Furthermore, we’re a generation that is obsessed with finding a bargain. Club committees need to appreciate that if something is too good to be true it probably is, therefore they should be on the lookout for fraudulent brokers offering cover with hidden terms.

Indeed, when people believe that they are getting higher priced insurance packages for a cheaper price, they are in fact getting minimal cover for a lower price. Should an incident happen that isn’t covered by your policy, you may be left with the full bill for repairs.

Ultimately club’s should not aimlessly choose the broker who offers the lowest price, but instead weigh up all the benefits of a dedicated broker, including the negotiated premium.

Why cheap insurance isn’t always the best

While club’s should be mindful of how much they spend on their insurance, spending too little can be extremely harmful. Missing key risks and areas of your club can leave your finances unprotected incase of an eventuality such as flood, fire or theft. Cheap insurance which operates through lowered limits and missed risks won’t fully cover your club if a claim were to happen.

However, expensive policies are not guaranteed to keep you fully covered – because it’s not the price that dictates the quality of the cover, it’s the inclusions and the limits of the policy.

So where is the balance between cutting costs and getting the right insurance coverage? Choosing the right level of insurance depends on the nature of your needs; every club has unique needs and unique risks. This is why the attention and experience of a dedicated broker is essential. An insurance broker will help negotiate with insurers on your behalf, and find the right balance between cost and covers, delivering on your needs.

Clubs shouldn’t risk underinsurance

For sports clubs, social clubs and SMEs, underinsurance is scarily common. A Chartered Institute of Loss Adjusters survey found that 44% of business interruption policies had inadequate sums insured. Inadequate sums insured is dictated by the valuation of your premises and clubhouse, as well as the cost to rebuild your club were it to be destroyed.

Avoid Ghost Brokers

Ghost brokers are fraudsters who sell clients cheap insurance deals that hold no legitimacy and provide no form of cover. The scam takes a few forms, but mainly consists of either: Pre-paid insurance company policies are doctored before being sold to clients, or, fake policies created are then sold to clients. As well as forged documents, fraudulent brokers may arrange and charge for a valid insurance policy which they will then cancel without your knowledge, leaving you uninsured and unaware.

The consequences of falling victim to this insurance scam are often disastrous, the clients having not only lost money but also now not insured for their clubhouse, building and contents, equipment – whatever it may be. Being uninsured or underinsured can lead to a fixed penalty notice. You are also liable for any damage caused or injury sustained during your period without lawful insurance.

What to prioritise when choosing a club insurance broker?

1. Understand your needs

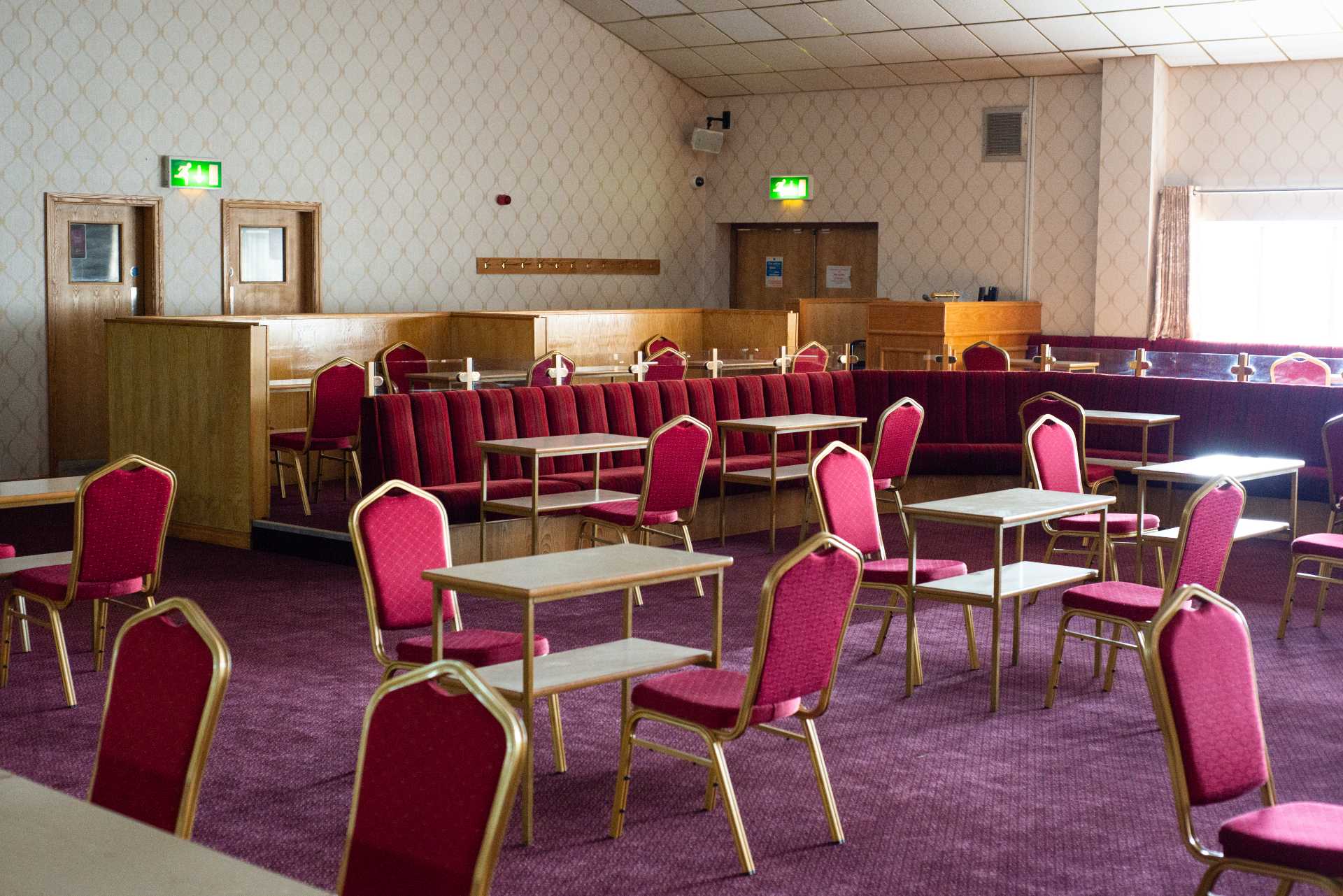

To get the right policy you need to understand your needs. Every club is different, with different capacity, membership, access points and fire safety procedures. Review your club regularly, any changes need to be communicated toy our insurer.

54% of SMEs have reviewed their insurance in the last 12 months, while 43% have not done so for more than a year. All businesses will face new risks every year and your insurance policy needs to be updated accordingly.

2. Check your liability limits

Your liability limit is the maximum amount which a liability insurance company will pay as a result of a single accident or injury to a person on your premises. Liability limits are the perfect example of not just needing cover, but needing need enough cover. The cover limits need to be enough to cover all of the costs for medical care, without you having to pay for anything other than your excess. Review your liability limits within your policy and assess whether it is sufficient.

3. Read reviews and testimonials

Reviews and testimonials by clients give a good indication as to the customer service level of your chosen insurance broker. At Club Insure, you can read our testimonials here, which include opinions from golf clubs, sports clubs, social clubs and working men’s clubs.

Good customer service and account manager, including visitations and taking the extra time to understand your club, could save you thousands in covering you properly. You’ll want good customer service or an account manager should you be unfortunate enough to have to make a claim.

4. Experience

An experience broker means they’ve seen everything before and know how to handle each situation perfectly. They have the tools and connections in place to get you sorted as quickly and as affordably as possible. Consider experience, depth and longstanding relationships a priority when choosing your club insurance broker.

What Insurance Options should I be aware of and what do they mean?

We’ve provided a quick gallery of the key insurance policies you need to have in place. Review your terms and ensure the following cover options are in place at your club:

- Public liability is essential and should include claims made by the public, compensation for injury or death, legal expense cover and property damages.

- Employers’ liability is legally mandatory and should include employee illness and injury cover, legal expense cover including compensation.

- Buildings insurance should be at a limit which covers a full rebuild of the property, catering for both repairs and damages.

- Content insurance is essential for covering against theft fire or floods, including money or stock lost.

- Business interruption is key to providing financial protection when disasters happen, covering any financial losses during the limited trading period following an incident, as well as staff costs.

Why Club Insure are the best insurance option for clubs

Ultimately, club’s should look for a premium that gives you the cover you need and at a cost effective price. You may not feel the benefit of paying more than the cheapest price for a basic package until a crisis happens. However when (not if) it does, you’ll be glad you have an insurance package tailored to your business in place to support you through a stressful time.

For the best cover at the best premium, talk to Club Insure. We are the UK’s most popular and most decorated club insurance provider. We will assess your insurance, for free, through our confidential review service, and inform you of what can be improved – whether it’s the premium price or the policy limits. Have a chat with us today by calling 0344 488 9204.

It just might save your club.