Don’t forget this before running a Euro Cup event

It’s easy to forget something important when planning for a big event like the Euro Cup or the World Cup. Note down these points if

Have your expenses and premiums gone up? Are you worried about renewal?

Call Club Insure.

We are currently dealing with a high volume of social clubs looking to get a better premium. We will negotiate with top insurers on your behalf, possessing access to the best cover at the best rates. Work with a dedicated handler who understands the needs of your business – what cover you need, and what you don’t.

It’s why so many social clubs are switching to Club Insure.

We’re dedicated to protecting the future of the leisure industry. It’s a diverse and exciting industry, and Social Clubs are an integral part of the sector. Social Club Insurance from a specialist broker is a necessity.

Your social club may be run by a small team, assisted by volunteers or part-time staff members. View us as an extension of your team – helping to provide comprehensive cover for all of your insurance requirements, plus assisting with health and safety management.

We’ll conduct a review in order to provide you with a proposal that demonstrates how we can improve your level of insurance cover without increasing the premium. We also offer monthly payment plans to help you spread the cost into manageable regular but smaller payments.

Thanks to our strong industry reputation, we’re able to work with the best insurers in the business. We’ll always find you the best rate going for the type of cover you want, so you can be confident knowing you have the best possible insurance package that completely caters to all your needs.

Insurance will cover you if an incident or accident occurs at your social club. If a customer or member of staff is involved in an accident, or if your property experiences damage, the policy will protect you from the financial impact these incidents could cause.

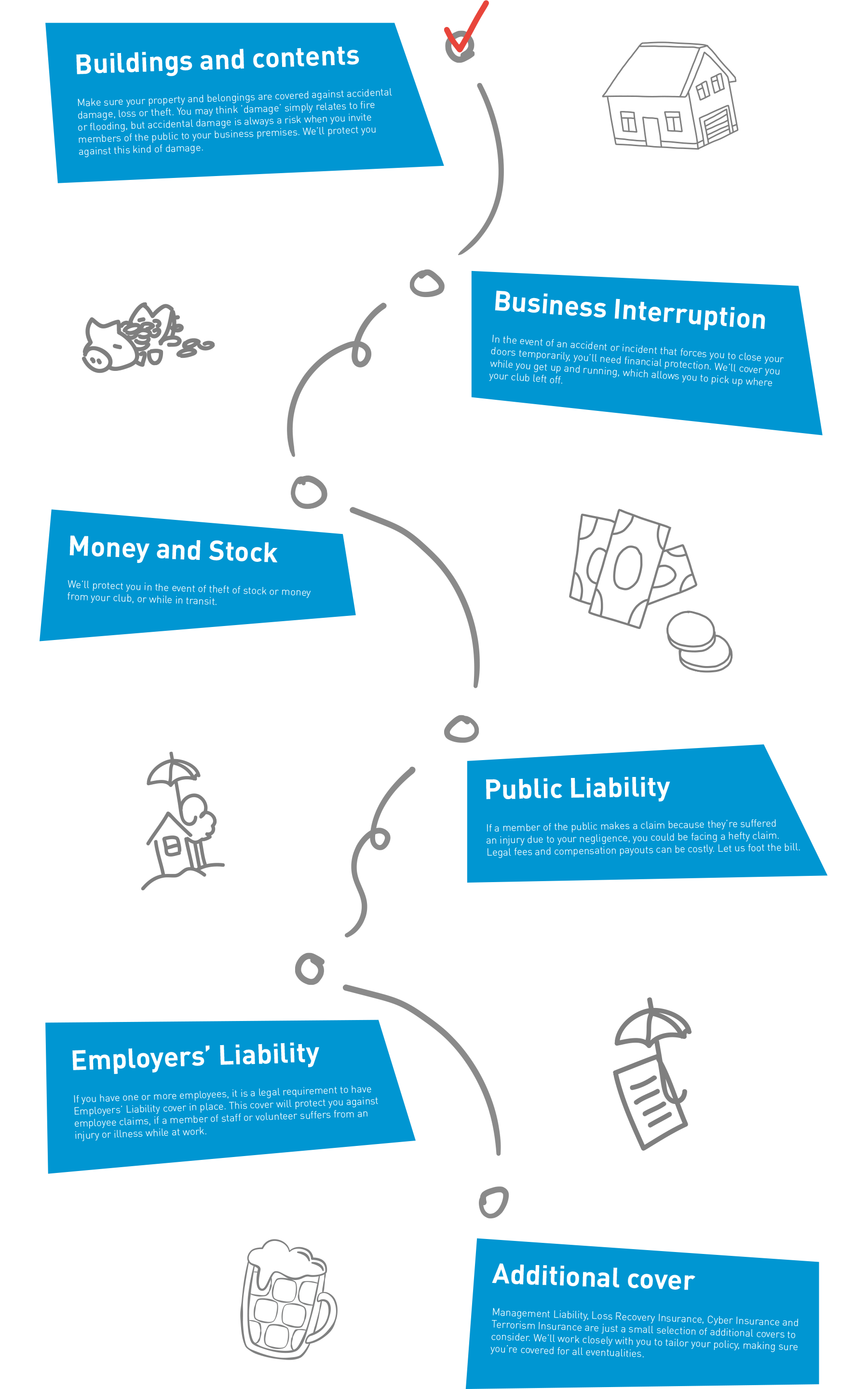

Make sure your property and belongings are covered against accidental damage, loss or theft. You may think ‘damage’ simply relates to fire or flooding, but accidental damage is always a risk when you invite members of the public to your business premises. We’ll protect you against this kind of damage.

In the event of an accident or incident that forces you to close your doors temporarily, you’ll need financial protection. We’ll cover you

while you get up and running, which allows you to pick up where

your club left off.

We’ll protect you in the event of theft of stock or money

from your club, or while in transit.

If a member of the public makes a claim because they’re suffered

an injury due to your negligence, you could be facing a hefty claim. Legal fees and compensation payouts can be costly. Let us foot the bill.

If you have one or more employees, it is a legal requirement to have Employers’ Liability cover in place. This cover will protect you against employee claims, if a member of staff or volunteer suffers from an injury or illness while at work.

Management Liability, Loss Recovery Insurance, Cyber Insurance and Terrorism Insurance are just a small selection of additional covers to consider. We’ll work closely with you to tailor your policy, making sure you’re covered for all eventualities.

“Initially we were impressed with Club Insure’s approach. Kingsley was excellent, respectful of time and not too pushy. During his visitation, he was balanced in his opinion, gave straightforward advice, and ultimately we felt his time with us added value. Club Insure were very thorough and patient in their explanations, which are qualities we believe are very important when working with a broker. They didn’t over promise and under deliver; they gave us the honest truth.”

“Amy, our account handler is always accessible and excellent in her assistance. Whenever I call, Club Insure have been available and Kingsley makes sure to return my calls the same day. I would 100% recommend Club Insure to other clubs.”

Our experienced team of specialists will oversee your individual account. In the event of a claim, your account handler will work with our in-house claims management team to offer tailored advice, guidance and support.

It’s easy to forget something important when planning for a big event like the Euro Cup or the World Cup. Note down these points if

A range of options are out there when looking for cricket club grants and funds. – UPDATED – Prime Minister Rishi Sunak has announced investment

80% of sports clubs could be uninsured, is yours? Unfortunately underinsurance is fairly common in the sports club insurance sector. Many businesses are at risk

Risk Management for Outdoor Storage External storage is useful for sports and social clubs, often being where materials like finished goods, flammable liquids, equipment, and

Club Insure Ltd

Romero House

8 Airport West

Lancaster Way

Leeds

Yorkshire

LS19 7ZA

© Club Insure Ltd Registered in England & Wales no. 03535054 Club Insure Is Authorised & Regulated by the Financial Conduct Authority no. 304875